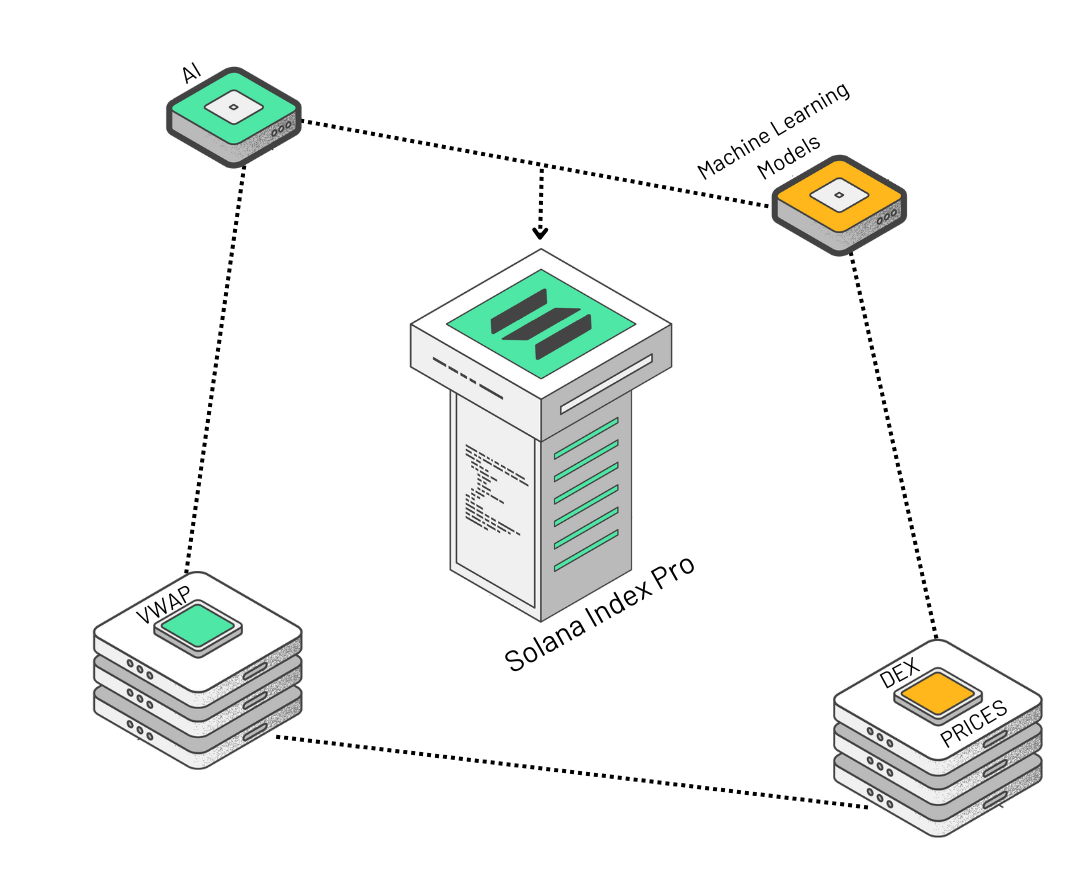

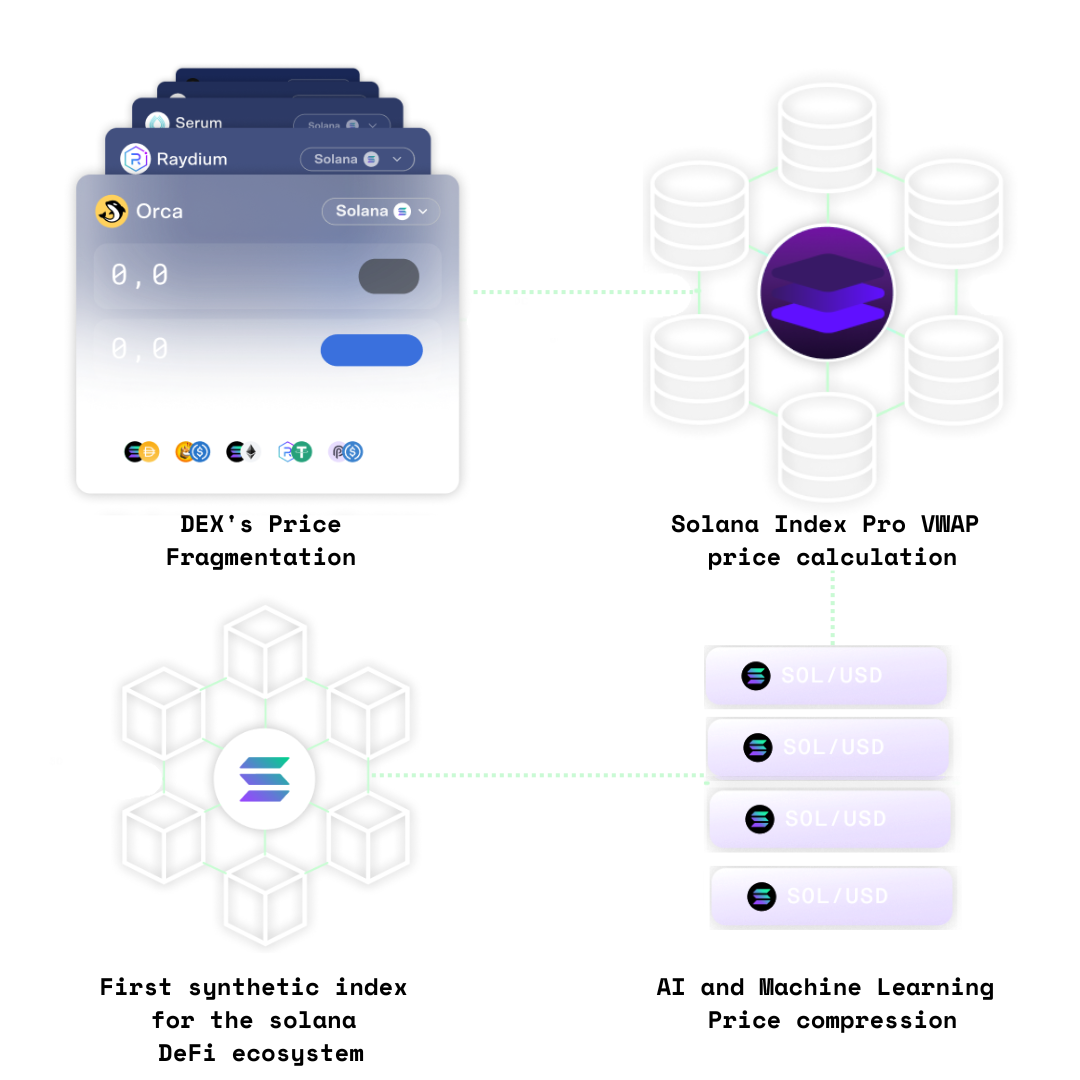

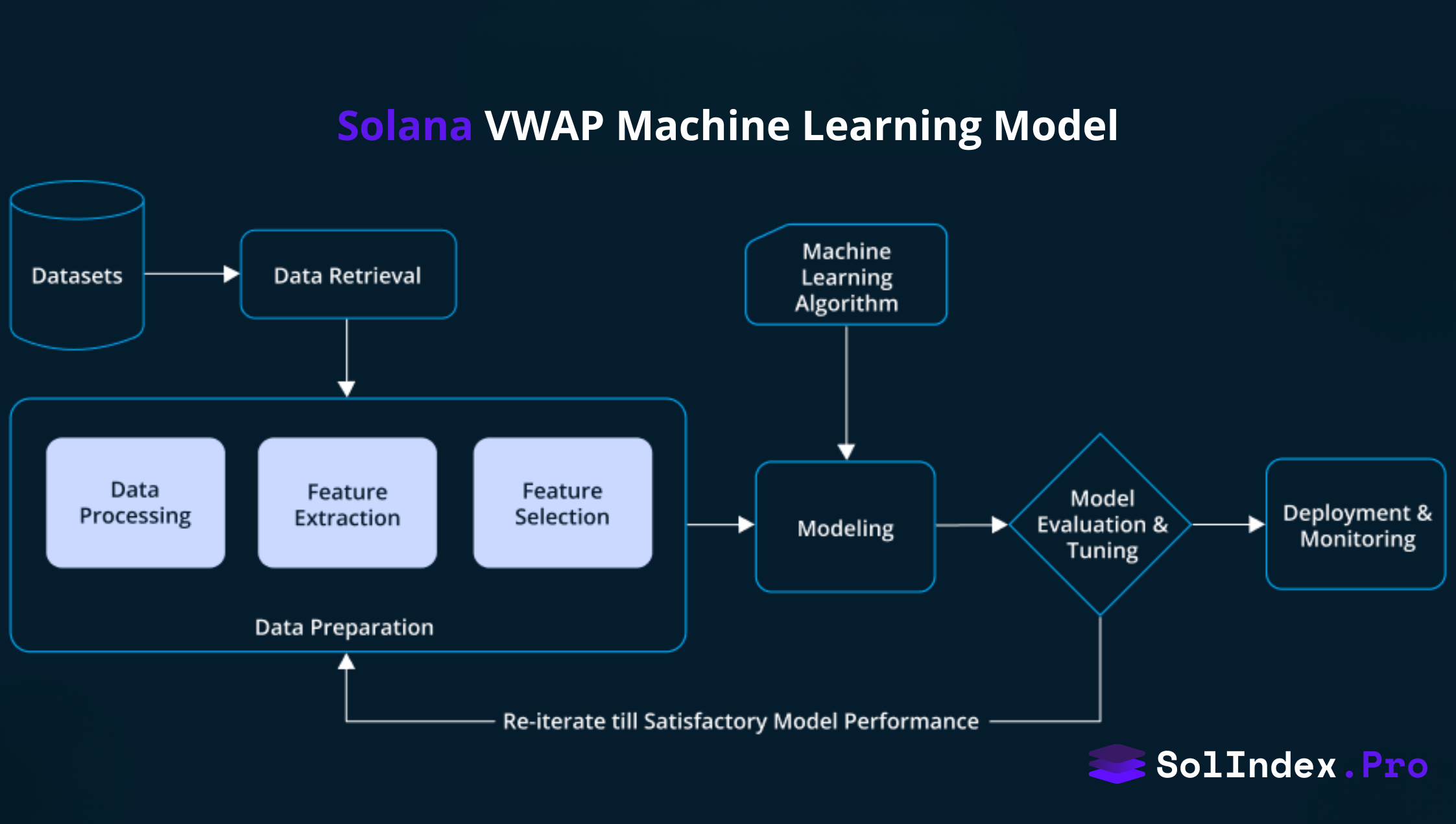

The VWAP calculation integrates data from major DEXs, weighting each price by its trading volume over a specified period. Here’s a breakdown of the VWAP process:

- Data Collection: Solana Index Pro continuously gathers real-time price and volume data from the main Solana DEXs. This data includes the current Solana price and the volume of Solana being traded on each exchange.

- Weighted Calculations: The platform calculates the VWAP by multiplying the price of Solana on each DEX by the volume traded on that DEX. This means that if Raydium has a high trading volume, the price from Raydium will have more influence in the VWAP calculation compared to a lower-volume DEX.